The IMF defaulted on Greece a long time ago

- June 30, 2015

Capitalism & Crisis

Even its own officials recognize that the IMF played a leading role in Greece’s economic collapse. It is time for the Fund to own up and pay its dues.

- Author

Tuesday marked the deadline for Greece to transfer a 1.6 billion euro debt repayment to the IMF. The country’s Finance Minister Yanis Varoufakis had already announced that his government could not — and would not — pay. And so, at 6pm Washington-time, 1am locally, Greece officially defaulted on the IMF.

The default is an unprecedented event in the history of finance: never before has a developed country fallen into arrears on a loan from the Fund. Unsurprisingly, the international press is already conjuring up unflattering comparisons with notorious failed states like Zimbabwe and Somalia, which are among the few countries to have gone down the same path of utter financial ignominy. With all due respect for Zimbabwe and Somalia, the implication of this media narrative is clear: Greece is about to become a hopeless basket case.

In truth, superficial parallels like these are dangerously misleading. Not only do they compare apples and oranges; they also end up obscuring the IMF’s own role in the decimation of the Greek economy, which basically made an eventual Greek default inevitable. By uncritically reproducing narratives of Greece’s “failure” to repay the Fund, many in the international media are directly overlooking the fierce internal criticism that top IMF officials have expressed about their own responsibility for the utter disaster of the Troika’s bailout programs.

Yes, it’s true: never before has a developed country failed to repay the IMF on time. But, then again, never before has a developed country experienced such a catastrophic economic collapse in peacetime — and never before have official creditors been so criminally complicit in producing the collapse (although the brutal structural adjustment programs in Latin America, Africa and East-Asia were in many ways even more inhumane).

Greece has by now lost a quarter of its total economic output since the start of the crisis. Unemployment is still higher than it was in the United States during the Great Depression. Public health and other public services have completely imploded. Almost 1 million Greeks are without health insurance; 11.000 people are estimated to have committed suicide as a result of economic hardship. The depth of this crisis is absolutely unprecedented, and the creditors themselves (including the IMF) owe a great deal of the responsibility.

Interestingly, the IMF itself has long since recognized this. Just consider what the Fund wrote in its ex-post evaluation of the first Greek bailout of 2010. The program, the IMF blatantly states, “only served to delay debt restructuring and allowed many private creditors to escape … leaving taxpayers and the official sector on the hook” (p. 28). Moreover, the Fund admits that “earlier debt restructuring could have eased the burden of adjustment on Greece and contributed to a less dramatic contraction in output” (p. 33).

In the same report, the IMF also conceded that “the burden of adjustment was not shared evenly across society” (p. 24); that “ownership of the program was limited” (p. 24); that “the program was based on a number of ambitious assumptions” (p. 26); that “the risks were explicitly flagged” (p.27); and that “ex-ante debt restructuring was not attempted” (p. 27).

“An upfront debt restructuring would have been better for Greece,” the Fund concludes, “although this was not acceptable to the euro partners. A delayed debt restructuring … provided a window for private creditors to reduce exposures and shift debt into official hands.” Or to put that in ordinary language: the IMF basically admits that it should have canceled a large chunk of Greece’s debt at the very start, but decided not to do so because the Europeans needed them to help save their private banks. There you have it, from the horse’s mouth.

Miranda Xafa, a former member on the IMF executive board, has reached the same conclusion. Noting that the reason for delaying a much-needed debt restructuring was simply to allow private banks to reduce their exposure to Greece, she penned a highly critical paper in which she confirms that “The exposure of core euro area banks, especially French and German banks, was a key reason why a debt restructuring was not attempted sooner.”

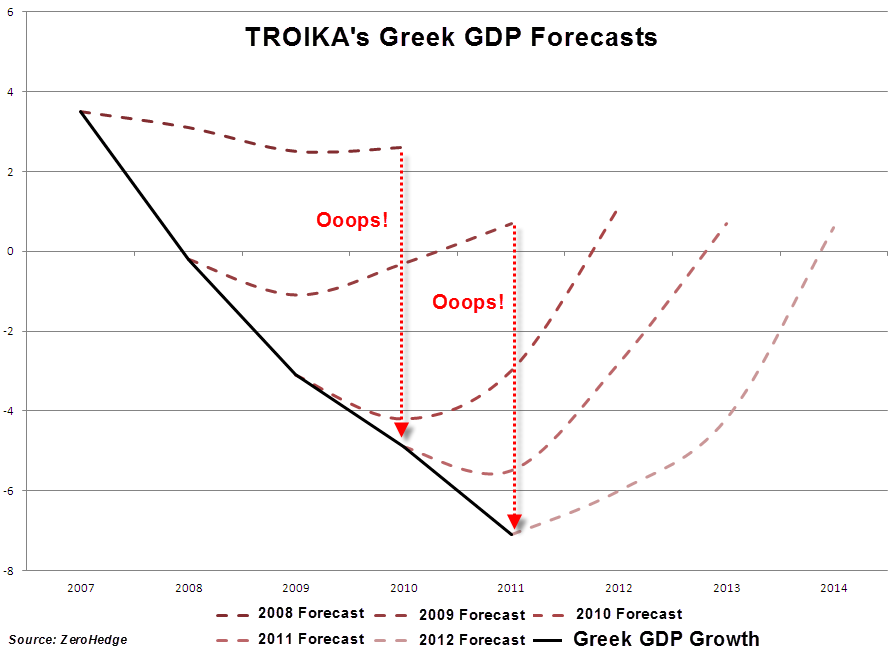

By early 2011 it was already clear that the first bailout would not be enough to keep Greece afloat. Unsurprisingly, given the ferocity of the austerity measures demanded by the IMF and the European creditors, the Greek economy was contracting much faster than the wildly optimistic IMF prognoses had foreseen (see the graph below). In a widely disseminated mea culpa, IMF chief economist Olivier Blanchard later acknowledged that the Fund’s unrealistic (and ultimately false) prognoses hinged on a set of assumptions that massively underestimated the contractionary effects of the Troika’s austerity measures.

This was no mere methodological error. According to Susan Schadler, former deputy director of the IMF’s European Department, the Fund’s notoriously inadequate multipliers were the direct outcome of a set of “fundamental political pressures” that compelled IMF staff to paint a much rosier picture of the Greek bailout program than reality merited.

The Fund’s scheme was obvious for everyone to see. As Martin Wolf of the Financial Times noted: “instead of making the debt sustainable, the programme merely let many private creditors escape unscathed. All this tells us depressing things about the politicisation of the IMF and the inability of the eurozone to act in the best interests of its weaker members.”

It was not all about the money, however. After 2012, the European banks had basically divested themselves of Greek debt and a Greek default no longer appeared to be a systemic risk. Still, the debt provided the Europeans with a powerful instrument to exert long-term fiscal control over Greece. Schadler:

Several interviewees suggested that apart from domestic political considerations, one reason the Europeans did not want to commit openly to absorbing the costs of the crisis and establishing an endgame [i.e., granting Greece debt relief] was that they felt it necessary to perpetuate uncertainty as a method of holding the feet of the Greek government to the fire.

Last Saturday, hours after Tsipras announced the Greek referendum, former IMF chief Dominique Strauss-Kahn decided to weigh in on the matter too. In a short paper entitled “Learning from one’s mistakes”, Strauss-Kahn (who was in charge of the Fund at the time of the first Greek bailout, until he resigned following a sex scandal involving rape allegations) said he was willing to “take responsibility” for his part in forcing an “asymmetrical” and overly “counter-cyclical” adjustment upon Greece.

The evidence for the IMF’s criminal complicity in the collapse of the Greek economy is simply overwhelming. Yes, the officials at the Fund bear direct responsibility for the years of untold suffering they have inflicted upon millions, including the tens of thousands who died because they could not obtain adequate medical treatment or who, driven to despair by the lack of economic prospects, took their own lives. In any civilized country, those responsible for such vast suffering and loss of life would have been sentenced to prison years ago.

In its review of the 2010 bailout, the IMF itself admitted that “in retrospect, the program served as a holding operation” to allow private creditors and domestic elites to escape the crisis without having to share in the burden of adjustment. This can only lead us to one possible conclusion: Greece may have defaulted on the IMF tonight, but the IMF itself defaulted on the Greeks a long, long time ago. It is high time for the creditors to pay their dues and return the immense moral and material debt they owe to the people of Greece.

It is time to cancel the debt.

Source URL — https://roarmag.org/essays/greece-imf-default-bailout/